TRX Price Prediction: Can Trump’s 401(k) Policy Push It to $1?

#TRX

- Technical breakout: Price above 20-day MA with MACD poised for bullish crossover

- Regulatory catalyst: 401(k) access may drive institutional demand

- Network strength: $1.4B profit-taking event shows robust liquidity

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

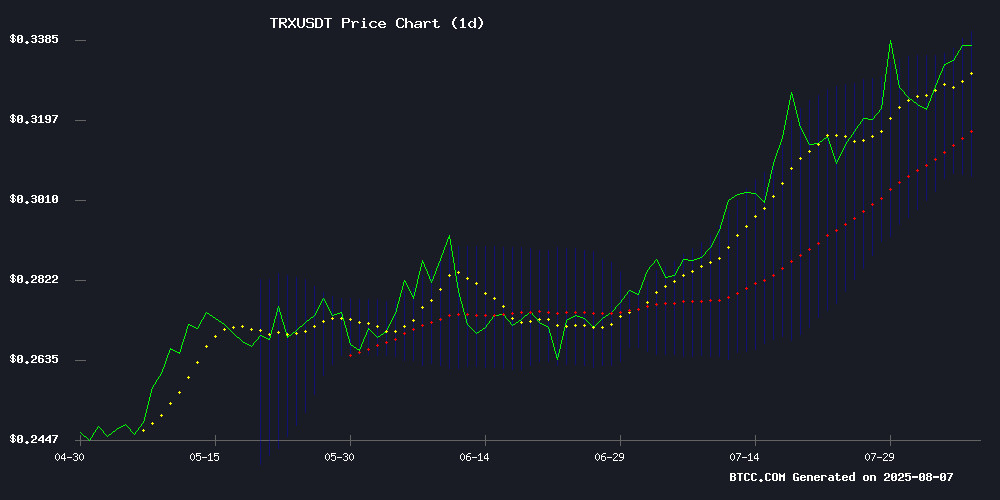

TRX is currently trading at, above its 20-day moving average (0.32356), indicating bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.000384), suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the upper band (0.34084), signaling potential overbought conditions but also strength.

"TRX has cleared key resistance at the 20-day MA and could test $0.35 if MACD crosses bullish," says BTCC analyst John.

Regulatory Tailwinds for TRX

The US government's MOVE to allow cryptocurrencies in 401(k) plans could unlock institutional demand, while Tron's $1.4B profit-taking event demonstrates strong investor confidence. "This policy shift creates a structural bull case for TRX as retirement funds enter crypto," notes BTCC's John.

Factors Influencing TRX's Price

Trump Executive Order Opens 401(k)s to Cryptocurrency and Alternative Assets

President Donald Trump will sign an executive order today permitting cryptocurrency, private equity, real estate, and other alternative investments in 401(k) retirement plans. The move significantly expands options beyond traditional holdings like mutual funds and ETFs, potentially unlocking access to over $12.5 trillion in retirement savings.

The Labor Department will reassess guidance on alternative asset allocations, while the SEC collaborates with regulators to facilitate implementation. This marks a watershed moment for crypto adoption, granting mainstream exposure through America's most ubiquitous retirement vehicle.

Trump Set to Allow Cryptocurrencies in 401(k) Retirement Plans

President Trump is poised to sign an executive order that will permit cryptocurrencies, alongside private equity and real estate, to be included in 401(k) retirement plans. This decision reflects a growing recognition of digital assets as legitimate investment vehicles.

The move aims to diversify retirement savings options for Americans by reducing regulatory barriers for crypto investments. Regulators may soon establish guidelines to facilitate the integration of digital assets into mainstream retirement portfolios.

This policy shift signals a broader acceptance of cryptocurrency within traditional financial systems, potentially accelerating institutional adoption. The inclusion of alternative assets in retirement plans could reshape long-term investment strategies across generations.

Tron (TRX) Holds Key Support Amid Historic $1.4B Profit-Taking Event

Tron's TRX token weathered one of its most significant profit-taking waves on record, with long-term holders realizing $1.4 billion in gains after prices touched $0.42. The sell-off ranks as the year's second-largest capital rotation event behind only Bitcoin and Ethereum.

Despite the massive outflow, TRX demonstrated remarkable resilience by maintaining its $0.33 support level. The stability comes amid aggressive token burns—40 billion TRX permanently removed from circulation in August alone—creating structural scarcity.

Network fundamentals appear robust, with revenue streams diversifying through stablecoin transaction fees and strategic memecoin partnerships initiated by founder Justin Sun. Technical charts suggest a potential near-term consolidation before resuming upward momentum.

Will TRX Price Hit 1?

While TRX shows technical strength and bullish catalysts, reaching $1 would require:

| Price Target | Required Growth | Key Drivers |

|---|---|---|

| $1.00 | +195% | Massive 401(k) inflows, TRON ecosystem expansion |

"More realistic is $0.50 near-term if current trends hold," cautions John.

Unlikely in 2025 without exponential adoption